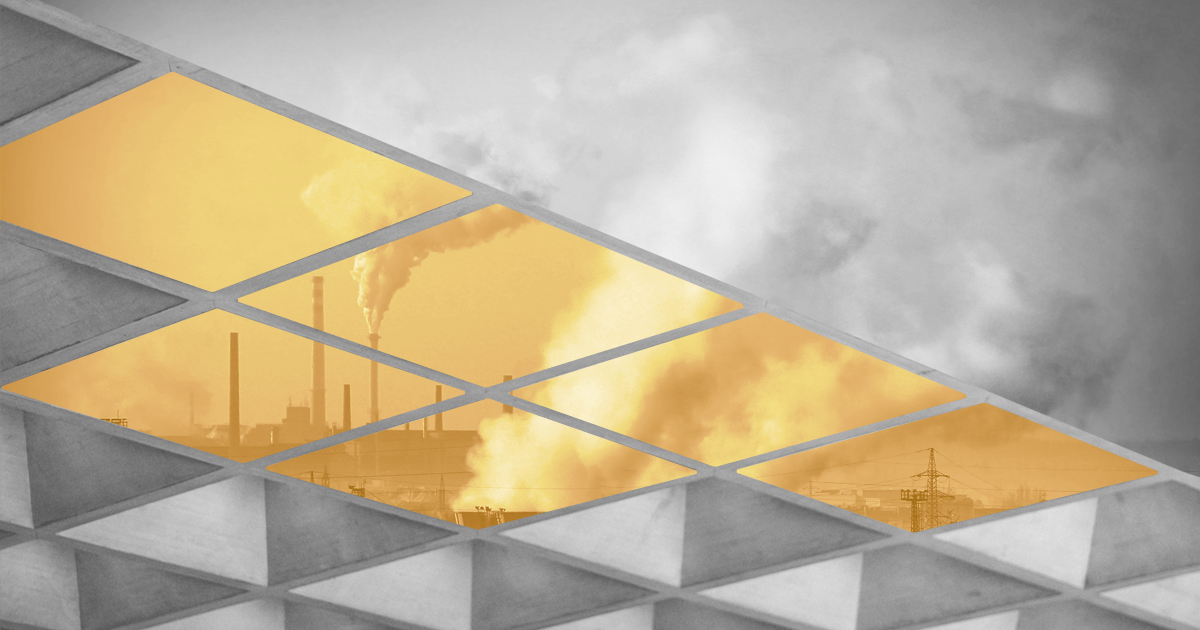

The tides are turning. Environmental, Social, and Governance (ESG) reporting is moving from a voluntary effort conducted by the few to one that regulators and investors mandate. In the not-so-distant future, and in some cases now, companies will be reporting climate and other sustainability information in the same way they disclose their financial information.

In this new normal, where ESG metrics and company finances are reported in the same way. Investors and regulators expect ESG data to be accurate, timely, and auditable. Investors, in particular, are now looking for assurances on the ESG metrics of their portfolio companies to understand how a company's sustainability and climate risks translate to investment risks. Investors need ESG data they can trust and be confident the data is accurate to make critical investment decisions. In short, they need “investor-grade reporting,” for ESG metrics.

The list of challenges companies face to ensure their ESG data is accurate, consistent, comparable, and auditable is endless. ESG data comes in many forms, shapes, and sizes and is spread across different departments of an organization making the collection and collation of this data and the assurance of its accuracy difficult. To collect this data, engagement across cross-functional teams within the organization to ensure good governance is critical. Using technology to aggregate data at scale is also key for full transparency and auditability.

What is Investor-Grade ESG Data?

Investor-grade ESG data is similar to how financial data is considered investor-grade - accurate, current, holistic, auditable, and comparable are all the attributes companies need for financial data as well as ESG data. By having such similar characteristics between the two datasets, companies already have the blueprint to replicate many of their practices and procedures used to report financial data to report and collect ESG data.

To repeat the same practices and procedures as they do when reporting their financial data, and ensure data quality, companies' ESG data needs to be audited internally and by a third party. Companies should start as early as possible and collect data in a controlled, repeatable, documented manner. The whole ESG reporting process should have board oversight to ensure that ESG reporting and performance are enmeshed in the culture and operations of a company in the same way as their financial reporting and performance.

Why Is Collecting Data For Investor-Grade ESG Reporting Difficult?

Because the collection and reporting of ESG data is new for many companies, and the processes are yet to be put in place for accurate and transparent reporting, there are many challenges in collecting ESG and climate data. When building these processes, it is important for sustainability teams to document controls and processes, as auditors can test these processes. Some of the common challenges for investor-grade ESG reporting include:

- Manual collection — ESG data comes in many different forms, in tonnes of recycled plastic waste, in the number of miles driven by the company's vehicle fleet, in board diversity percentages, and much more. The manual collection and aggregation of this data is time and resource intensive, and riskier for internal control purposes.

- Incomplete data — Data is sometimes lacking in completeness. Some companies may only have emissions data for their facilities and vehicle fleet and fail to report the emissions of their value chain, which may make up the vast majority of their emissions. For auditing purposes, documenting what type of data you collect and proving data completeness is important.

- Data is often decentralized — ESG data is usually fragmented across siloed internal divisions (human resources, logistics, operations, and more), which have varying degrees of knowledge on how to collect and aggregate ESG data.

Why is Investor-Grade Reporting Important?

The implications of an increasingly unpredictable climate, biodiversity loss, inequality, and many other environmental and social issues increase companies' exposure to physical and transition risks. Focusing on the accurate collection and reporting of physical risks (sea level rises, pollinator disruption, droughts, etc.) and transition risks (changing regulation, market shifts, etc.) will allow companies to understand and assess their ESG risks better. The other reasons for conducting investor-grade reporting include:

- Growing stakeholder demands: Increasingly climate and sustainability-conscious consumers, investors seeing climate risk and investment risk, and regulators looking to protect financial markets are all looking for accurate sustainability information.

- Need for Data Accuracy and Transparency: The collection and reporting of accurate and transparent ESG data will ensure better decision-making, strategy building, and target setting.

- Evolving Regulatory Landscape: The SEC recently released a proposal for the disclosure of climate information to be reported with financial information. Other jurisdictions like the EU with its Corporate Sustainability Reporting Directive (CSRD), which mandates climate and other ESG reporting. The EU’s legislation requires the reporting of scope 3 emissions and will require US multinationals working in the EU to report auditable carbon data.

- Increasing Exposure to Climate Risk: Accurate climate data will give companies an accurate understanding of how climate change could affect their market, facilities, and supply chains, allowing them to create strategies to mitigate them.

Benefits of Investor-Grade Reporting

Along with meeting the needs of investors, regulators, and other stakeholders for decision-useful accurate ESG data, building more rigorous "investor-grade" processes has a series of internal benefits that will drive value for your organization:

- Achieve commitments: The right investor-grade data will be required to track decarbonization targets and support internal and external sustainability goals.

- Ensure executive visibility: Having strong climate data will ensure leadership has visibility into climate risks and progress toward goals.

- Build resiliency: As the global focus on ESG continues to grow, companies will need to integrate ESG performance into operations to stay competitive and compliant.

- Reduce risks: Building strong ESG data systems to support climate reporting will ensure your organization can defend its climate position and reduce risks around what legislation is passing and when.

- Increase transparency: Climate data reporting with the same rigor as financial reporting will provide deep insights into how well an organization is managing its GHG emissions.

Being a laggard is no longer an option in an ever-evolving climate landscape. The risk is too high not to act now. Providing stakeholders with investor-grade reporting will help companies be resilient in a dynamic market and regulatory landscape and meet climate and other commitments.

How to Move Your Organization Toward Investor-Grade ESG Reporting

Too many companies still consider ESG and climate as an afterthought; no longer will a piecemeal approach to collecting and reporting ESG data cut it. To move forward with ESG investor-grade reporting, companies need to get engagement from the executive level down and build a strategy to start today and slowly iterate on processes and policies for accurate ESG data collection and reporting. Cross-functional engagement will be key in enabling the correct governance for the appropriate and accurate collection of data.

Cross-Functional Engagement is Key to Success

Engaging with a cross-functional group guided by ESG and sustainability teams will be essential for investor-grade ESG reporting. The integration of legal, finance, executives, and many other teams within the organization will be necessary for the proper governance, aggregation of data, and ensuring data is accurate and consistent. Cross-functional engagement ensures buy-in throughout the company embedding ESG and climate in the culture of the company. It also ensures that each team is engaged in the process and sharing accurate and timely information and data. The below image and list are a snapshot of who should be involved and why:

- The legal team should be involved because of the litigation risks associated with compliance reporting.

- Finance departments should be integrated into the process, as they will be able to translate climate and ESG risks into financial risks.

- An internal auditing team will be critical to ensuring compliance with any regulations and assurance of data accuracy.

Companies should include other teams on a case-by-case basis depending on the structure of a business; logistics teams, marketing teams, investor relations, and others could all be included in a governance strategy to ensure reporting is transparent, consistent, comprehensive, and aligned across the whole organization.

Steps to be Successful with Investor-Grade Reporting

Leveraging the cross-functional expertise across an organization, as outlined above, builds the controls and procedures needed for investor-grade reporting. However, successful investor-grade reporting needs more than just good governance to ensure the accuracy, auditability, and transparency needed. Here are 10 steps to ensure successful investor-grade reporting:

1. Leverage the cross-functional domain expertise - As outlined earlier, take advantage of experience across the company building visibility, controls, and process.

2. Make sure you have the right software for investor-grade reporting - Enabling cross-functional teams to aggregate with the full auditability and transparency required for investor-grade reporting can only be achieved at scale through technology.

3. Measure and report in alignment with ESG and climate measurement and reporting standards - Aligning with the correct ESG reporting frameworks, such as the TCFD, GHG Protocol, Taskforce for Nature-related Disclosures (TNFD), and more, will ensure the correct data is being collected and reported in the right way.

4. Ensure proper governance around procedures and processes - Maintain cross-functional engagement and alignment and iterate on governance processes.

5. Improve stakeholder transparency - Give clear and consistent reporting on methodologies on how ESG data was collected, ESG strategies, and progress towards goals, to promote trust.

7. Identify climate risks and opportunities from emissions footprint - Ensure the long-term sustainability of the company by assessing the market, regulatory, and consumer changes and by protecting your company's facilities and products from the physical risks of climate change.

8. Integrate risks or opportunities into business strategy - Combine these risks and opportunities into the wider business strategy to ensure the company stays competitive and looks better to investors.

9. Set a reduction target - Set achievable goals, such as net zero emissions by 2050, increase board diversity, reduce deforestation, and track and report progress toward them.

10. Benchmark peers - To get a better understanding of where the company sits among its competitors and jurisdiction and where improvements need to be made.

Successful investor-grade reporting requires support from the highest levels and clearly delineated roles, processes, procedures, and strategies. Technologies and alignment with key sustainability frameworks can ensure clarity and make the process a lot less onerous.

Credible ESG Data for Stakeholders

Integrating ESG and climate reporting into investor reporting will soon become necessary to stay compliant and competitive. It will need to be treated with the same level of rigor and importance as financial reporting. While collecting and measuring the data might seem overwhelming and complex, the benefits will far outweigh the challenges.

Companies are stepping up to the challenge and providing enterprises with the technology to collect and register accurate climate and ESG data. From a climate perspective, to account for the carbon of large corporations and financial institutions, a technological solution is vital.

Using technology will make ESG investor-grade reporting a far less daunting prospect and will enable companies to ensure compliance with the growing number of ESG regulations. Technology allows companies to spend less time collecting data and assuring its accuracy and more time building decarbonization strategies and mitigating other sustainability impacts.